Programming the Future

X Algorithmic exists to eliminate friction in the financial system; helping you to create, transfer, convert and custody value in the tokenised economy.

What we do

At X Algorithmic we build programmable banking applications (PBAs), decentralised applications (DApps) and smart contracts that simplify, standardise and automate financial operations, improving existing capabilities and bringing new business models to life.

Speed & efficiency with programmable banking

With programmable banking, financial institutions, organisations and businesses can simplify, standardise and automate financial operations using Programmable Banking Applications that can be applied directly to their bank account. Instead of having to build and maintain their own platforms and integrating with third party APIs, institutions can find PBAs for services such as AML, KYC and Payment Processing in the Pave Bank App Store and apply these to their bank accounts.

Eliminating friction in financial services

PBAs are not only preconfigured with the information required by API service providers to connect to their APIs but they can also be composed together to provide complete solutions rather than point integrations. PBAs encapsulate API orchestration and choreography between different systems, both on‒chain and off‒chain, automatically connecting to billing, monitoring, reporting, risk and reconciliation services. This leaves you to focus on the configurations that are important to your financial and commercial operations.

Fusing TradFi with DeFi

Beyond the financial and temporal efficiencies gained from eliminating the friction of onboarding essential services, PBAs give institutions the opportunity to access new products and services or build their own. With the advent of Real World Asset Tokenisation, X Algorithmic will pioneer the creation of DApps and smart contracts across multiple blockchains that will ultimately be accessible by PBAs. By fusing TradFi and DeFi with PBAs, we lower the barriers to entry for all market participants while ensuring compliance and regulatory demands are upheld at all times in all jurisdictions.

What's in it for you?

Money is evolving. Through the dematerialisation of specie to ledger entries and onto the digitalisation and decentralisation of those ledgers, we are now embarking on the tokenisation of different forms of money and assets. The tokenised economy offers profound opportunities for all market participants and Programmable Banking makes these opportunities accessible to everyone.

Eliminating Friction

At X Algorithmic we use AI at every stage of the PBA development lifecycle, simplifying processes before creating standardised components that are reused, reducing maintenance overheads, improving security and decreasing financial and temporal costs. Finally we automate processes, safe in the knowledge that we are building on top of a strong foundation.

Driving Progress

Programmable banking creates opportunities for all market participants. Eliminating barriers to entry into TradFi markets is not simply a matter of increasing competition for the benefit of consumers; rather, entirely new business models will flourish when creators and innovators are incentivised to participate in the tokenised economy.

Real World Asset Tokenisation

Programmable Banking

Programmable Banking represents the next logical stage of progress in banking. With the advent of programmable money in the form of digital assets and smart contracts, programmable banking enables a unified ledger embedded directly into your bank account giving you frictionless access to the tokenised economy.

For Institutions

Programmable banking offers institutions a unique way to customise every aspect of their banking experience and automate their financial operations. PBAs enable institutions to tailor their financial services to meet specific needs, enhancing user experience while simultaneously eliminating the friction associated with integrating with API service providers or accessing DApps and smart contracts on blockchains.

For Regulators

Programmable banking simplifies compliance and reporting disclosure requirements for market participants in the jurisdictions where they operate. Changes to regulations can be issued and adhered to more quickly and cost effectively creating a more robust regulatory regime that encourages both domestic and foreign investment.

For Developers and Engineers

Programmable banking is the application of Turing Complete Computation applied directly at the account level with all the possibilities that opens for developers to express their creativity. Developers can use the full power of computing unlocking new opportunities for creative solutions. Programmable Banking Applications offer a playground for imagination, where developers and engineers can build smart, automated solutions, all integrated seamlessly with banking infrastructure and blockchains.

“The fusion of TradFi and DeFi will give rise to a new era of financial innovation, allowing entrepreneurs to reimagine how value is created, exchanged, and stored in the tokenised economy.”

For Entrepreneurs and Innovators:

Programmable banking opens up a world of possibilities in the emerging tokenised economy. With the ability to tokenise real-world assets, such as property, commodities, and even intellectual property, entrepreneurs can unlock new forms of value creation, transfer, conversion and custody. Programmable Banking Applications orchestrating DApps and smart contracts built on various blockchains will enable innovative business models, fractional ownership, and enhanced liquidity for previously illiquid assets. By lowering the barriers to entry and ensuring compliance with regulatory requirements, programmable banking empowers entrepreneurs to pioneer groundbreaking solutions that bridge the gap between traditional finance and decentralised finance (DeFi).

For Banks

We recognise that for existing banks to build programmable banking capabilities into their platforms is simply impossible, but that doesn’t mean that existing banks can’t use PBAs. Super charge correspondent banking by creating an account with Pave Bank and begin applying PBAs to remove friction from your legacy systems.

Why we do it

We believe Programmable Banking is better.

Whether your business is a FinTech, Cryptoasset Business, a Startup, Global Enterprise or Bank, to leverage the services provided by your partners, suppliers, service providers and counterparties your only options are to build your own platform or to use someone else's platform. Both approaches can be costly, time consuming and come with their own risks. We believe Programmable Banking is a better option not only in terms of cost and time but also for the opportunities it makes accessible in a fast changing tokenised economy.

Current State

Programmable Banking

Stop Integrating, Start Building

We know how long it can take and how much it can cost to identify, evaluate and integrate service partner APIs into your platform. With Programmable Banking you can select an existing PBA from the Pave Bank App Store or build your own PBA and apply it directly to your bank account.

It's easier, faster and more secure than building your own API integration and costs less than using a counterparty platform.

You can test the PBA in a staging environment with either synthetic or live transaction data and then promote your PBA to a canary network where it can be battle tested with real value. When you're ready, agree to the terms of service for the PBA and flip the switch to go live mainnet.

Compose PBAs To Build Finished Products

Instead of having to build new components in your platform to orchestrate API calls for your solution you can compose PBAs together to build a complete product, not just from a customers perspective, but also from a regulatory, compliance and reporting perspective.

Manage All Your PBAs Using The Pave Bank Portal

The Pave Bank portal is a "Single Pane of Glass" for managing all the PBAs applied to your bank accounts. Monitor, metre, log, audit and report all the key metrics of your PBAs from your bank account's portal.

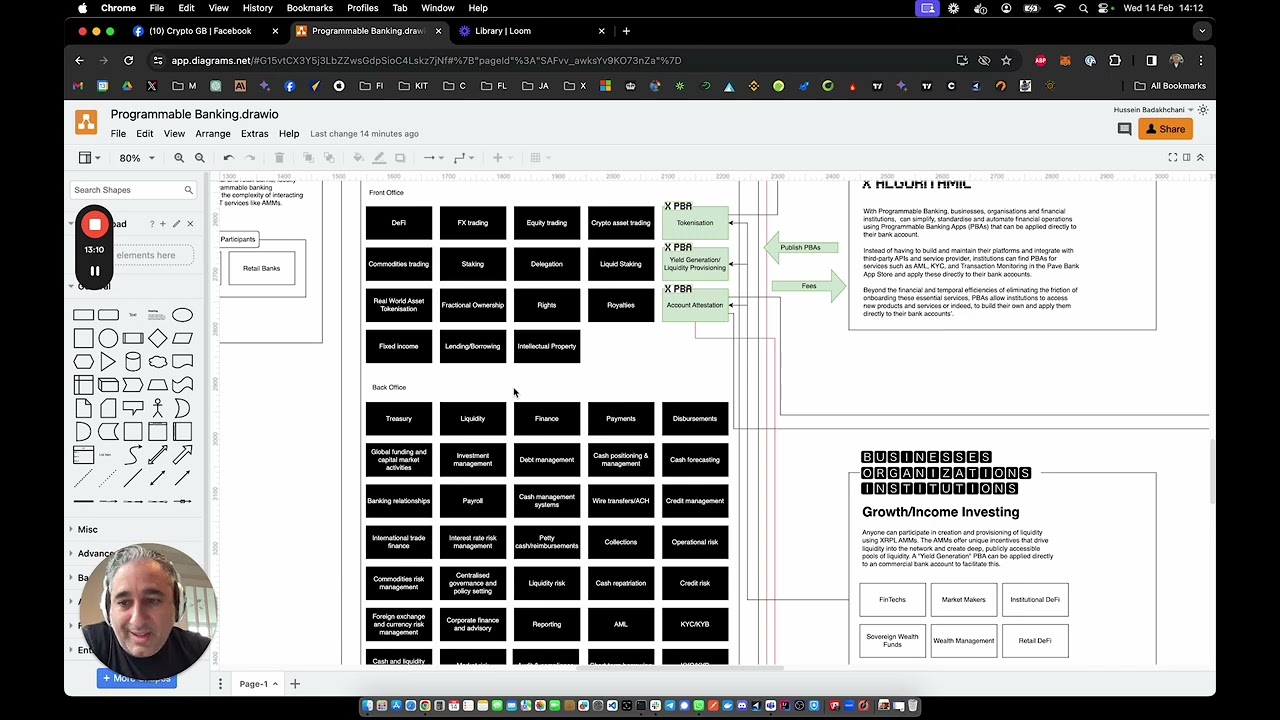

Conceptual Architecture for a Tokenised Economy with Programmable Banking and Programmable Money.

X Algorithmic specialises in building applications and systems that eliminate friction in the banking and financial sector for institutions. The advent of Pave Bank, the world's first fully programmable bank, has focused our attention on building programmable banking applications that will seamlessly fuse TradFi and DeFi.

How we do it

We are guided by fundamental principles and we are practical in the application of those principles. The creation of financial infrastructure demands an abundance of caution, but that must be balanced against commercial realities. It is for these reasons that we have chosen an uncompromising approach to code creation, testing and deployment.

PBAs, DApps and smart contracts for financial operations must be failsafe and foolproof.

Deterministic Scenario Testing is a crucial approach for ensuring the reliability and stability of financial applications. Unlike other software domains where "move fast and break things" may be an acceptable philosophy, financial operations require a higher level of rigour and predictability. The consequences of errors or failures in financial transaction processing can be severe, leading to financial losses, reputational damage, and regulatory penalties.

While stochastic unit and API surface testing have their place in certain software development contexts, they are not sufficient for financial applications. These testing approaches rely on randomised inputs and probabilistic outcomes, which can leave gaps in test coverage and fail to capture critical edge cases. In contrast, Deterministic Scenario Testing focuses on defining and executing specific, well‒defined test scenarios that cover the full range of expected behaviours and outcomes.

The benefits of Deterministic Scenario Testing for financial applications are manifold. First and foremost, it provides a high level of confidence in the correctness and reliability of the software. By explicitly defining and testing all relevant scenarios, including both happy paths and error conditions, Deterministic Scenario Testing helps ensure that the financial application will behave predictably and correctly under all circumstances. This is essential for maintaining the integrity of financial data and transactions.

Moreover, Deterministic Scenario Testing promotes collaboration and shared understanding among product owners, engineers, and quality assurance specialists. By using Behavior Driven Development (BDD) techniques, the team can define the expected behaviours and outcomes of the software in a format that is easily understood by all stakeholders, regardless of their technical background. This helps to align everyone's understanding of the requirements and reduces the risk of misinterpretation or miscommunication.

In BDD, feature files are written in plain English using a structured format known as Gherkin. These files describe the different scenarios that exercise a particular feature, specifying the preconditions, actions, and expected outcomes. The use of natural language makes the feature files accessible to non‒technical stakeholders, allowing them to review and validate the scenarios. This collaborative approach helps to ensure that the software meets the business requirements and user expectations.

Another key advantage of Deterministic Scenario Testing with BDD is that the feature files serve as living documentation. Unlike traditional documentation that can quickly become outdated as the software evolves, feature files are executable specifications that are constantly validated against the actual behaviour of the software. This means that the documentation always remains current and accurately reflects the system's functionality. Moreover, the feature files create institutional memory, capturing the business logic and requirements in a form that can be easily understood and maintained over time, even as team members come and go.

From a technical perspective, the feature files in BDD can be easily converted into automated tests using tools like Cucumber or SpecFlow. This automation helps to ensure that the scenarios are consistently executed and validated, reducing the risk of human error and increasing the efficiency of the testing process. Automated Deterministic Scenario Testing can be integrated into the continuous integration and delivery pipeline, providing rapid feedback on the quality and correctness of the software changes.

At X Algorithmic, we harness the power of AI throughout the entire software development life cycle, from ideation to deployment and beyond. By integrating AI at every stage, we ensure that our financial applications are not only technologically fit for purpose but also intelligent, adaptable, and user-centric.

During the discovery and elaboration phases, AI-powered tools assist in gathering and analysing market insights, user feedback, and regulatory requirements, enabling us to create product specifications that are aligned with the needs of our target audience. In the design and proof-of-concept stages, AI algorithms optimise system architectures, identify potential vulnerabilities, and simulate real-world scenarios to validate the feasibility and robustness of our solutions.

As we progress to the development of minimal viable products and production-ready applications, AI enhances our testing and quality assurance processes, ensuring that our software meets the highest standards of security, reliability, and performance. Finally, in the maintenance and support phase, AI-driven monitoring and analytics enable us to proactively identify and resolve issues, continuously improve our applications, and deliver exceptional user experiences.

By embedding AI at every stage of the software development life cycle, we stay at the forefront of innovation, creating financial applications that are intelligent, efficient, and future-proof.

We use the term 'code circuits' to evolve our practices in DevOps, Continuous Integration, Continuous Deployment and Continuous Testing. The essence of code circuits lies in implementing workflows that not only aim to deliver high‒quality software but also maintain a comprehensive record of code changes.

A key feature of code circuits is their incorporation of automated feedback loops. These loops facilitate early detection of potential issues and security vulnerabilities through static and dynamic code analysis. Additionally, functional testing ensures the software meets its intended purposes, while non‒functional testing assesses performance and reliability.

Security is paramount in code circuits. Through rigorous security testing and simulated attacks, we ensure our software is fortified against various threats and adheres to industry standards, reinforcing our commitment to safeguarding our products.

Volume and performance tuning are integral to code circuits, allowing us to simulate realistic heavy‒use scenarios. This analysis helps identify bottlenecks, optimises resource utilisation, and confirms the system's capability to manage the anticipated user load efficiently.

By adopting code circuits, we enhance the quality, reliability, and security of our PBAs, DApps and smart contracts. The real‒time insights provided by automated feedback loops enable swift issue resolution and continuous improvement. This methodology fosters a culture of perpetual enhancement, ensuring each code modification undergoes extensive testing and contributes to the system's overall betterment.

As the landscape of software development evolves, code circuits position us to deliver exceptional software products while maintaining our commitment to quality and efficiency. Through automation, feedback loops, and thorough testing, code circuits empower us to develop software that is reliable and secure.

The development of financial applications, including Programmable Banking Applications, Decentralised Applications, and smart contracts, stands at the forefront of the blockchain revolution and the tokenised economy, where the fusion of technology and financial innovation is reshaping the global economic landscape.

In this dynamic and rapidly evolving field, the value of diverse experience cannot be overstated as it provides a comprehensive understanding of the intricacies of financial markets, regulatory environments, and the technological foundations that underpin the security, reliability, and trust of these groundbreaking applications.

When it comes to the development of Programmable Banking Applications, DApps, and smart contracts, experience is the key to success. These sophisticated platforms require not only exceptional technical skills but also a deep understanding of user needs, regulatory compliance, and the ability to anticipate and mitigate potential security vulnerabilities. Experienced developers bring a holistic perspective to the development process, drawing upon their diverse knowledge to create solutions that are innovative, resilient, and user‒centric. They possess the foresight to navigate the unique challenges and opportunities presented by the financial technology landscape, ensuring that the resulting applications are secure, reliable, and aligned with the needs of the target audience.

Moreover, developers with experience gained from working in diverse financial environments across different jurisdictions bring an invaluable global perspective to the table. Their exposure to a wide range of financial systems, cultural nuances, and regulatory frameworks enables them to create solutions that are adaptable and scalable on an international scale. This experience fosters an appreciation for the complexity of global financial markets and the importance of developing technology that can eliminate friction in financial services.

Beyond technical and cultural insights, experienced developers in the financial technology sector also recognize the philosophical importance of diverse perspectives. They understand that the development of financial applications is not just about coding; it is about creating solutions that have the potential to transform lives and reshape the economic landscape for the public good.

Testing DApps and smart contracts

Testing DApps and smart contracts using testnets and canary networks is crucial for ensuring the security, reliability, and performance of blockchain-based solutions. Our PBAs can connect to DApps and smart contracts deployed on testnets and where they exist, on canary nets. This comprehensive testing approach is essential for building robust DApps and smart contracts that can withstand the challenges and demands of real-world use cases.

Testnets, short for test networks, are simulated blockchain environments used by developers to test and debug new features, upgrades, and applications before deploying them on the main blockchain network, referred to as the mainnet. Testnets play a crucial role in the development and refinement of blockchain technologies, allowing developers to experiment and validate their code in a safe and controlled setting.

One of the primary purposes of testnets is to provide a sandbox environment for developers to test their DApps and smart contracts, and other blockchain-based solutions. By deploying their code on a testnet, developers can observe how their applications behave under various conditions, identify potential bugs or vulnerabilities, and make necessary adjustments before releasing them on the mainnet.

Testnets typically mimic the functionality and characteristics of their corresponding mainnets, but with a few key differences. First, testnets usually have a separate blockchain instance, meaning that transactions and data on the testnet do not affect the mainnet. This separation ensures that any errors or issues encountered during testing do not have real-world consequences or impact the integrity of the mainnet.

Another important aspect of testnets is the use of test tokens or faucets. Unlike mainnets, where tokens have real monetary value, testnets provide developers with a mechanism to obtain test tokens for free or with minimal effort. These test tokens allow developers to simulate transactions, test smart contract functionality, and verify the performance of their applications without incurring actual costs.

Testnets also serve as a collaborative platform for developers, allowing them to share their work, seek feedback from the community, and engage in peer review. By opening up their code to the wider developer community, developers can benefit from the collective knowledge and expertise of others, leading to more robust and secure blockchain solutions.

Moreover, testnets play a vital role in the governance and consensus mechanisms of blockchain networks. Before implementing any changes or upgrades to the mainnet, such as new consensus algorithms or protocol modifications, these updates are first tested and validated on the testnet. This process allows stakeholders, including developers, validators, and the broader community, to assess the impact and viability of the proposed changes and provide feedback before they are implemented on the mainnet.

Canary networks have emerged as an invaluable tool for testing and refining new features and upgrades in blockchain ecosystems in ways that were not possible for traditional financial applications. Think of canary networks as bug bounties on steroids! Unlike traditional testnets, which often have unlimited token supplies and lack real-world market conditions, canary networks create a game theoretic battleground for trialling the behaviour of DApps and smart contracts with real value.

One of the key advantages of canary networks is their ability to attract real users who are aware of the experimental nature of the platform. These users engage with the network, knowing that there may be risks involved, but are motivated to participate due to the potential benefits and rewards. The game theoretic environment offered by canary networks is a more authentic testing ground, as the network is exposed to real‒world user behaviour, transactions, and market dynamics all incentivised with real value.

Canary networks serve as an initial stage in a blockchain's governance system, allowing the community to propose, test, and implement new features and upgrades before they are deployed on the main network. This approach ensures that any potential issues or vulnerabilities are identified and addressed in a controlled environment, minimising the risk to the main network and its users.

The use of canary networks extends beyond just testing new features. They also provide an opportunity to observe how the network responds to various market conditions and user behaviour. For example, in the case of the FLR Loans protocol on a canary network, issues related to market manipulation and the impact of rapidly declining asset prices on the stability of the protocol were exposed. These issues were impossible to detect in a traditional testnet; however, the presence of real users and market incentives on the canary network brought them to light.

Canary networks allow developers and the community to gather valuable feedback and insights from real users. This feedback can be used to refine the design and implementation of new features, ensuring that they meet the needs and expectations of the user base. By involving the community in the testing and governance process, canary networks foster a sense of collaboration and shared responsibility in the development and growth of the blockchain ecosystem.

Ultimately, canary networks provide a unique and valuable approach to testing and refining blockchain features and upgrades. By combining the benefits of real user participation, market conditions, and controlled experimentation, canary networks enable blockchain projects to identify and address potential issues before they impact the main network. The use of canary networks can contribute to the overall stability, security, and success of blockchain ecosystems.

Mainnets, short for main networks, are the primary, fully functional, and operational blockchain networks that are used for real-world transactions, asset storage, and the deployment of decentralised applications. Mainnets are the live, production-ready versions of blockchain networks, where the full value and utility of the blockchain ecosystem are realised.

Unlike testnets, which are used for testing and development purposes, and canary nets which test gamethoric behaviours, mainnets are the final, stable versions of blockchain networks that are open to the public and are used for real-world transactions. Mainnets are where users can send and receive cryptocurrencies, interact with DApps, and participate in the governance and consensus mechanisms of the blockchain network.

One of the key characteristics of mainnets is their security and immutability. Transactions recorded on the mainnet are considered final and cannot be altered or reversed, providing a high level of trust and integrity to the blockchain ecosystem. Mainnets employ various consensus algorithms, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS), to ensure the validity and security of transactions, as well as to prevent double-spending and other malicious activities.

Mainnets are also where the native cryptocurrencies or tokens of a blockchain network are used for real-world transactions and have actual monetary value. These tokens are used to pay for transaction fees, participate in governance decisions, and incentivize network participants, such as miners or validators, to maintain the security and stability of the network.

The launch of a mainnet is a significant milestone for any blockchain project, as it marks the transition from the development and testing phase to a fully operational and public network. Before launching a mainnet, blockchain projects typically undergo extensive testing and auditing to ensure the security, scalability, and reliability of the network.

Mainnets are also the foundation for the development and deployment of DApps. Developers can build and deploy their DApps on the mainnet, allowing users to interact with these applications and leverage the benefits of blockchain technology, such as decentralisation, transparency, and immutability. The success and adoption of DApps on a mainnet can significantly contribute to the growth and value of the overall blockchain ecosystem.

As mainnets are open to the public and are used for real-world transactions, they are subject to various legal and regulatory requirements. Blockchain projects must navigate the complex landscape of legal and compliance issues, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, to ensure the legitimacy and long-term viability of their mainnets.

Open Source & Community Development

While the development of PBAs and the DApps and smart contracts they use may be proprietary, the tools that we use to design, build, test and deploy these components will be open source and made available to the broader community of developers.Our commitment to keeping this tooling open source is driven by our belief that open source and community development will not only create superior PBAs, DApps and smart contracts but will also create a network that will sustain the future development of programmable banking.

About our team

Our founders bring with them a wealth of practical experience in banking, financial services, cryptoassets, regulatory and commercial law as well as product design and delivery.

Petter

Co-Founder

Petter has extensive experience in growth and product strategy roles within the FinTech and startup sectors. He focuses on fostering growth by working closely with the community to identify and prioritise features that drive their success. Petter's approach is pragmatic and places emphasis on collective achievements and customer success.

At X Algorithmic, Petter applies his FinTech background to drive business development and product innovation. His hands‒on approach, developed through leadership roles such as Managing Director at Moneff, brings practical insights to our mission. Petter's ability to translate industry knowledge into concrete strategies is a valuable asset.

Petter's role at X Algorithmic is to position us and our customers for growth and innovation.

Hoos

Founder

Hoos is a career technologist with over 25 years of experience working in banking, financial service and payments spanning the Dot‒com bubble, the FinTech revolution, the advent of Bitcoin and Crypto Currencies and now the drive towards the creation of the Tokenised Economy.

Hoos has executive and founding team member experience in both enterprise and startup environments for financial institutions in three continents (Europe, Asia and Africa) such as Bankers Automated Clearing System (BACS) UK, Deutsche Bank UK, VocaLink – MasterCard UK, Wave Money Myanmar, YouTrip Hong Kong and Singapore, Ziglu UK, Noah UK, Alsoug Cashi Egypt and most recently Pave Bank Georgia.

As the founder of X Algorithmic he is now bringing the breadth and depth of lifetime experience and expertise to help firms to sieze the opportunities presented by the tokenised economy.

Louis

Co-founder

Louis is an English solicitor with extensive legal expertise in the energy sector, specialising in project finance and regulation. He brings with him a strong background in legal practice, including senior positions in both international law firms and in‒house legal teams.

In recent years Louis has transitioned into the FinTech sector, applying his legal skills to offer strategic guidance, taking on directorial roles in cutting‒edge investment opportunities.

Louis's combination of energy sector experience and involvement in FinTech makes him a valuable asset for X Algorithmic, bringing with him a proven track record of driving projects forward and ensuring compliance in complex regulatory landscapes.